Discovery and WarnerMedia officially closed on Friday their highly anticipated merger. Warner Bros. Discovery (WBD) began full operations effective today, with CEO David Zaslav at the helm.

“With our collective assets and diversified business model, Warner Bros. Discovery offers the most differentiated and complete portfolio of content across film, television and streaming,” said Zaslav in a statement. “We are confident that we can bring more choice to consumers around the globe while fostering creativity and creating value for shareholders.”

Zaslav on Thursday selected his picks for WBD's leadership team, including several executives who have worked at both companies. The announcement followed the resignation of former WarnerMedia CEO Jason Kilar earlier last week.

WarnerMedia joins Discovery in good shape, Kilar wrote in a Medium post yesterday, with WarnerMedia ranked among the top three direct-to-consumer global media companies. Its success can be primarily attributed to HBO Max, which ended 2021 with 73.8 million global subscribers. Whereas Discovery+, Discovery’s proprietary streaming platform, closed last year with 22 million total subscribers, a notable number given its status as a niche platform.

AT&T, WarnerMedia’s parent company, received $40.4 billion as part of the transaction. CEO John Stankey said the company's shareholders will have a "significant stake" in WBD and its future successes. AT&T shareholders received 0.24 shares of the newly combined WBD for each share of AT&T they held at close on Friday. As a result, AT&T shareholders received 1.7 billion shares of WBD, representing 71% of WBD shares on a fully diluted basis.

The carrier seeks to revitalize its business, following the WarnerMedia spin-off as well as AT&T's divestiture of its DirectTV business last year.

RELATED: AT&T still looks weak after divestitures, says Moffett

"We expect to invest for growth, strengthen our balance sheet and reduce our debt, all while continuing to pay an attractive dividend that puts us among the top dividend paying stocks in America," Stankey said. “In WarnerMedia, Discovery inherits a talented and innovative team and a dynamic growing and global company that is well positioned to lead the transformation that’s taking place across media and entertainment, direct-to-consumer distribution and technology."

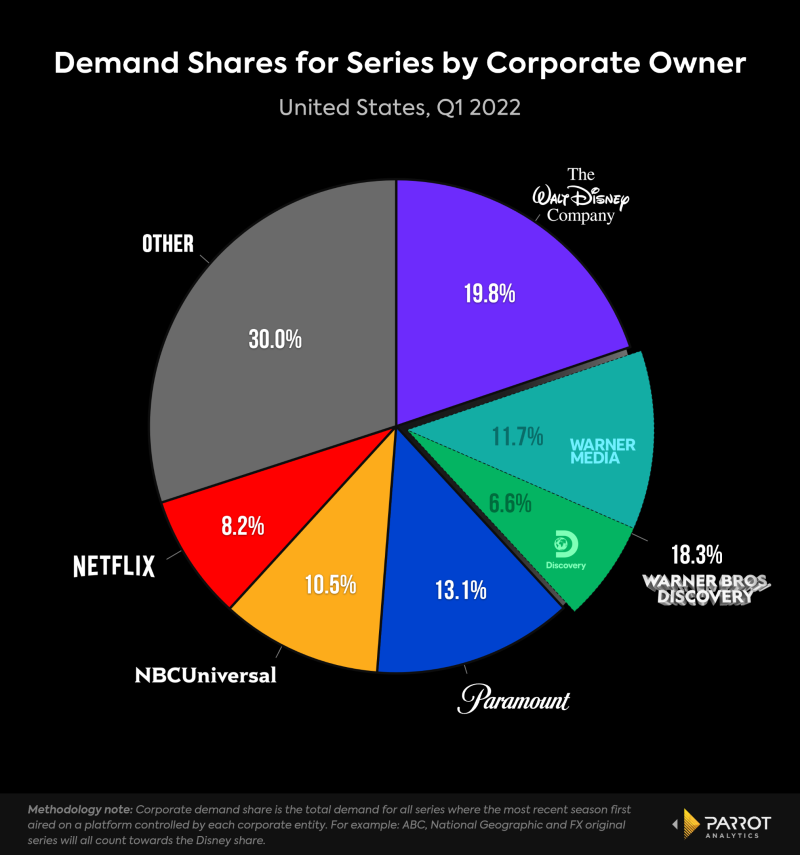

Discovery CFO Gunnar Wiedenfels said last month WBD will initially offer HBO Max and Discovery+ as a bundle, eventually combining both into a single platform. The consolidated entertainment catalog provides WBD an advantage in vertically integrated streaming. Disney, Netflix, Paramount Global, NBCUniversal and now WBD control 70% of U.S. audience demand for all TV content, a Parrot Analytics spokesperson told Fierce Video.

Discovery and WarnerMedia tout a combined 18.3% corporate demand share of U.S. audience demand, whereas as separate entities they would only hold 6.6% and 11.7% respectively. WBD's demand share is slightly behind that of Disney's 19.8% share, which is ranked the highest out of the top five media companies. The narrow corporate playing field signifies how the OTT space is getting further consolidated.